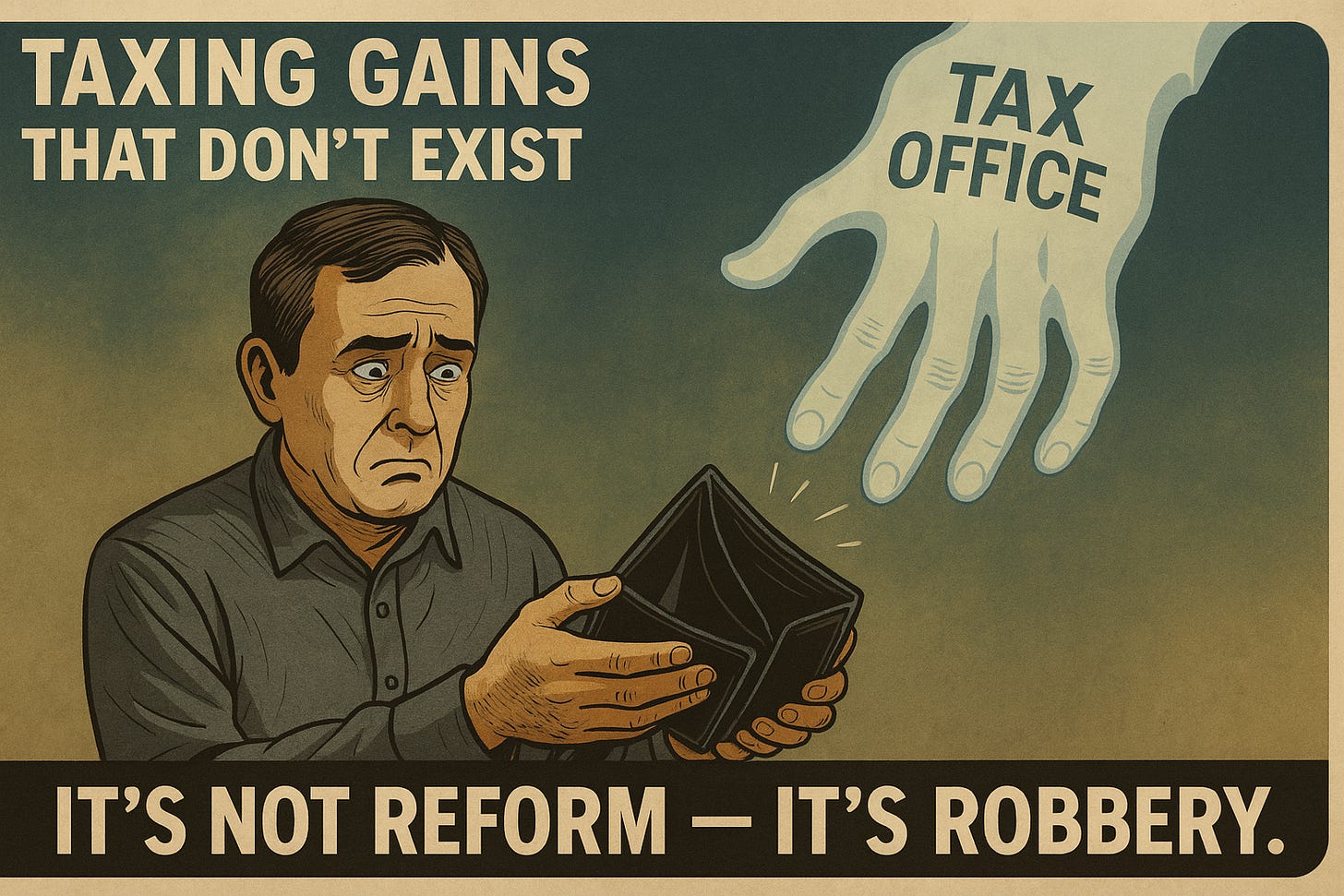

Taxing the Unreal

It's not reform — it's robbery

Time to get a grip — we're heading down a very slippery slope.

Welcome to the dangerous new era of superannuation — where you're forced to pay tax on gains that haven't been realised and may never be realised. That’s the outcome of Labor’s latest tax grab, targeting Australians with super balances over $3 million—and possibly $2 million if the Greens have their way.

While your first instinct may be to shrug this off — “$2–3 million? That’s for the rich.” But don’t be so sure.

This threshold won’t be indexed to inflation, meaning its real-world value will shrink over time. What seems out of reach today could trap you — or your children — tomorrow.

With the compulsory employer super guarantee now locked in at 12%, even an average-income worker entering the workforce today could cross the $3 million line by retirement — simply by investing responsibly over a 40-year career. This isn’t a tax on the elite. It’s a ticking time bomb for the next generation.

Of course the Labor government has couched this as a 'modest' reform — but there’s nothing modest about taxing unrealised gains.

No other country globally taxes unrealised gains as it's considered unfair, complex, and distortionary. Australia would be one of the first developed nations to cross this line — and not in a good way.

And there’s nothing modest about a threshold that silently shrinks each year thanks to inflation. This is pure overreach wrapped in soft language.

This isn’t just a tax — it’s a shift in philosophy: from taxing income to taxing ownership. It punishes self-reliance and middle-class values.

Responsible savers and investors are being treated like cash cows simply for planning ahead. And perhaps most tellingly, this policy disproportionately affects those with self-managed super funds — Australians who have chosen to manage their own retirement savings rather than hand it over to large institutions. The more super that’s independently managed, the less control government and union-linked funds have over the flow of investment capital. This is particularly inconvenient for a Labor government heavily aligned with union-dominated industry super funds.

Undermining self-managed super weakens independent financial decision-making — and strengthens institutional power.

Once again we see this isn’t just about revenue — it’s about control.

You could owe tax on a paper gain — even if your investments haven’t been sold and may later fall in value. These “gains” are often illusory, especially when inflation is ignored.

Taxing phantom profits while quietly benefiting from currency erosion isn’t economic stewardship — it’s fiscal sleight of hand.

Taxing the unreal is more than a policy flaw — it’s a financial illusion…

Worse still, politicians are exempt. Those on defined benefit pensions, including federal MPs, won’t be subject to this new tax. One rule for them, another for the rest of us. It’s enough to make your blood boil.

Back to the slippery slope — the precedent here is dangerous.

If unrealised gains can be taxed inside super today, what’s to stop the next government targeting your investments, your property — even your family home?

This policy doesn’t just threaten retirement plans. It also incentivises wealthy individuals and high-value investors to relocate to jurisdictions with more stable and transparent tax systems. As capital, talent and wealthy individuals flow out, the tax burden shifts further onto everyday Australians. It punishes diligence, erodes trust, and undermines the very behaviours that once made Australia strong.

This is short-term politics dressed up as reform — risking long-term damage to a system that once rewarded responsibility.

Signal Boost

If this hit home, don’t keep it to yourself. The more people who understand this, the harder it becomes to ignore. Consider sharing this post with friends and family to raise awareness — or better yet, start your own conversation.

Comms Check

In Print

The Mount Barker Courier published a condensed version of this letter on the 2nd July 2025. Here's how it ran in the paper:

Disclaimer:

All views expressed are the personal views of Darren Kelly. They are independent of any official role or organisation and reflect an ongoing commitment to open discussion and democratic integrity.